Systematic Asset Management

A simple long-term strategy to achieve strong, absolute performance

We believe in a systematic, rule-based investment philosophy. As nobody can consistently predict the market, we like to focus on a clear, rule-based investment process. A passive investment strategy with an active asset selection and allocation without currency risk. No emotions, no trading or market timing. Only physical investments (underlyings), no structured products. Few positions, well diversified to keep the running costs low and enhance the performance.

“The biggest risk in investing is the investors own emotions“

Yves Hauser, CIO Finaport Zurich

INVESTMENT STATISTIC

The biggest losses in a portfolio do not occur during corrections, its the long-term underperformance in bull markets which is most significant

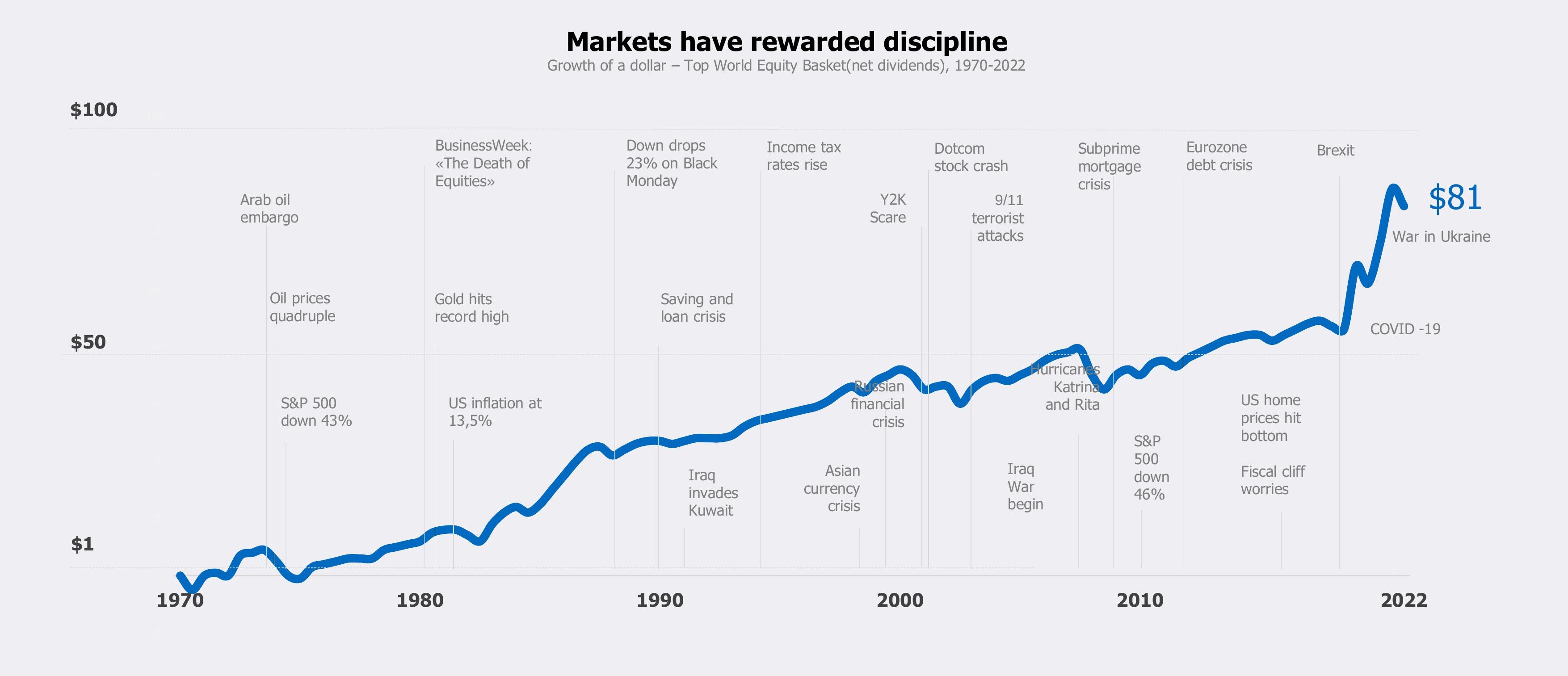

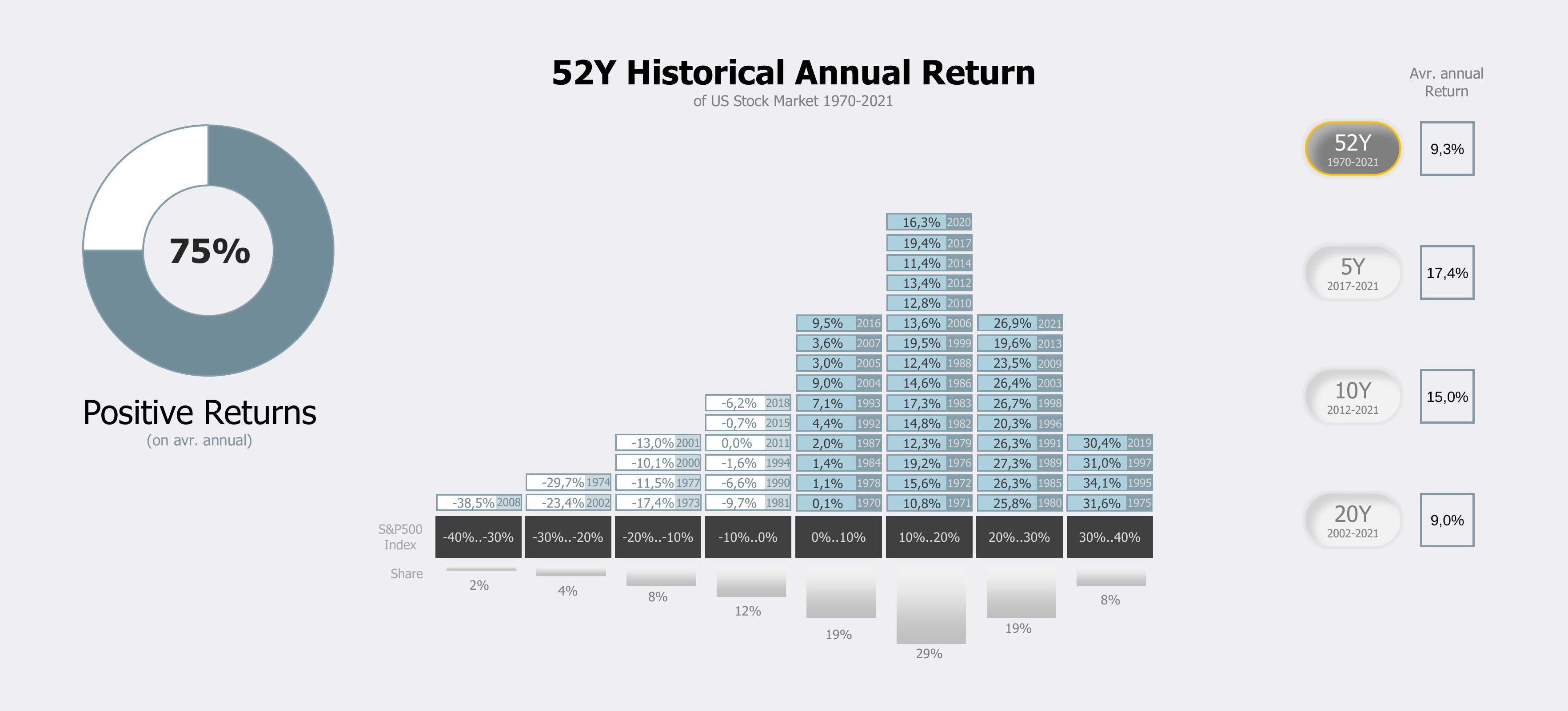

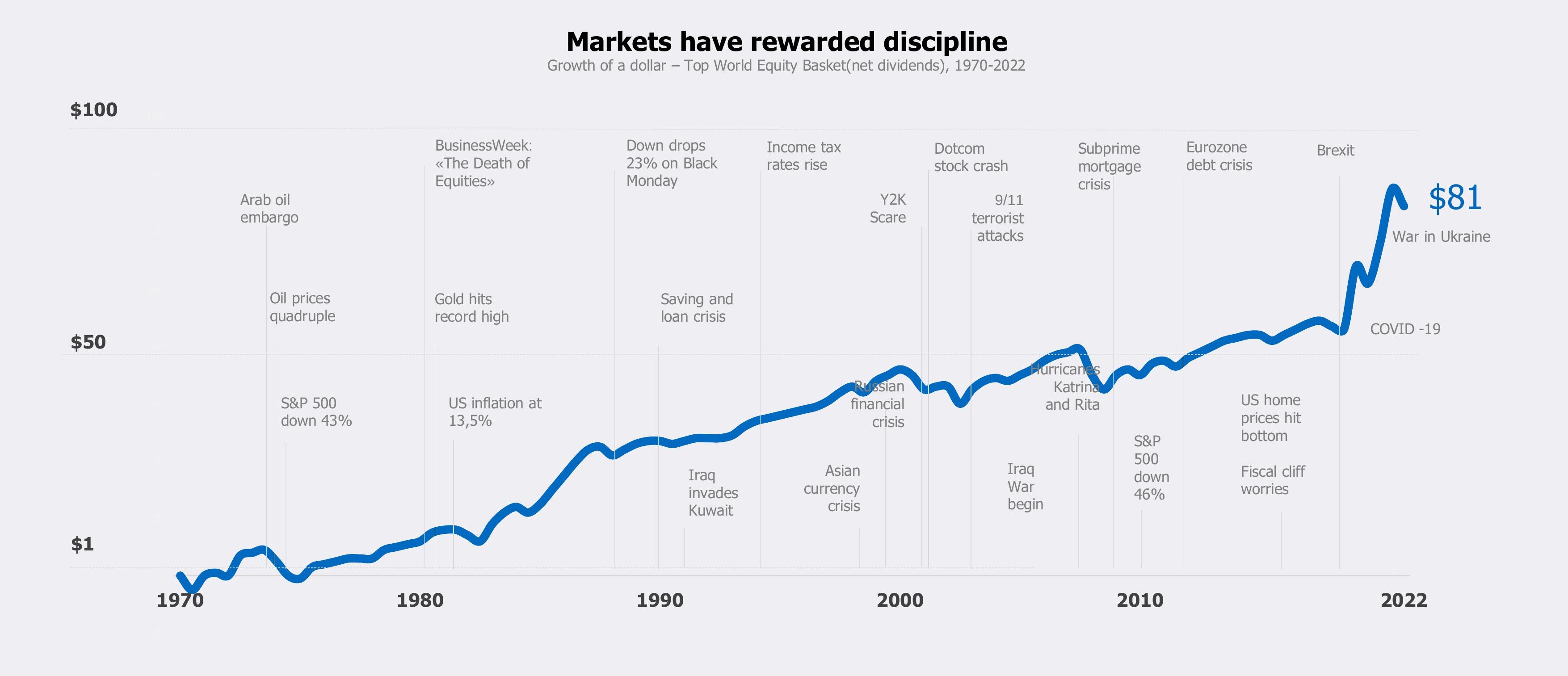

Long-term investments bring more profit

Focus only on what you can control. A disciplined investors looks beyond the concerns of today to the long-term growth potential of the market

Emotions often override reason when it comes to investment decisions, leading to irrational and destructive behavior

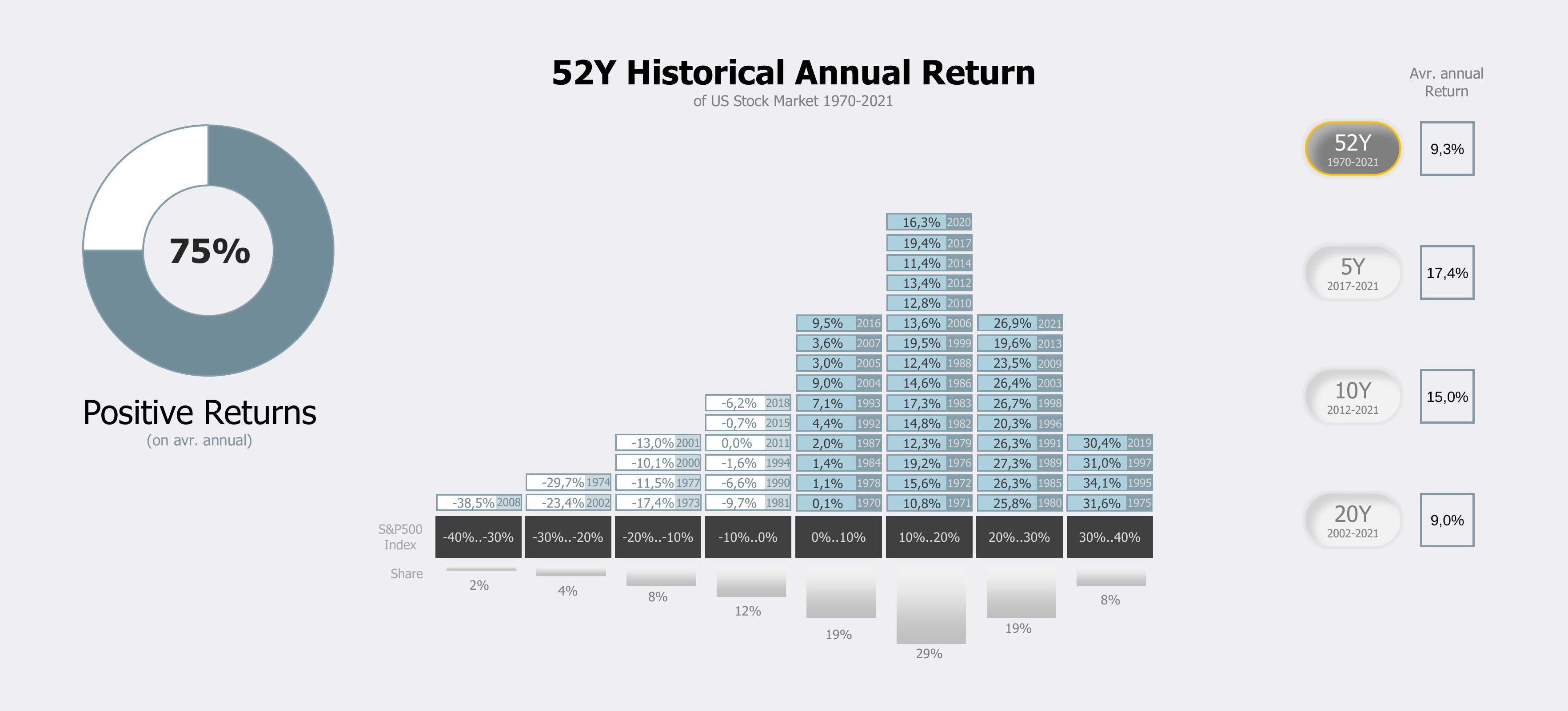

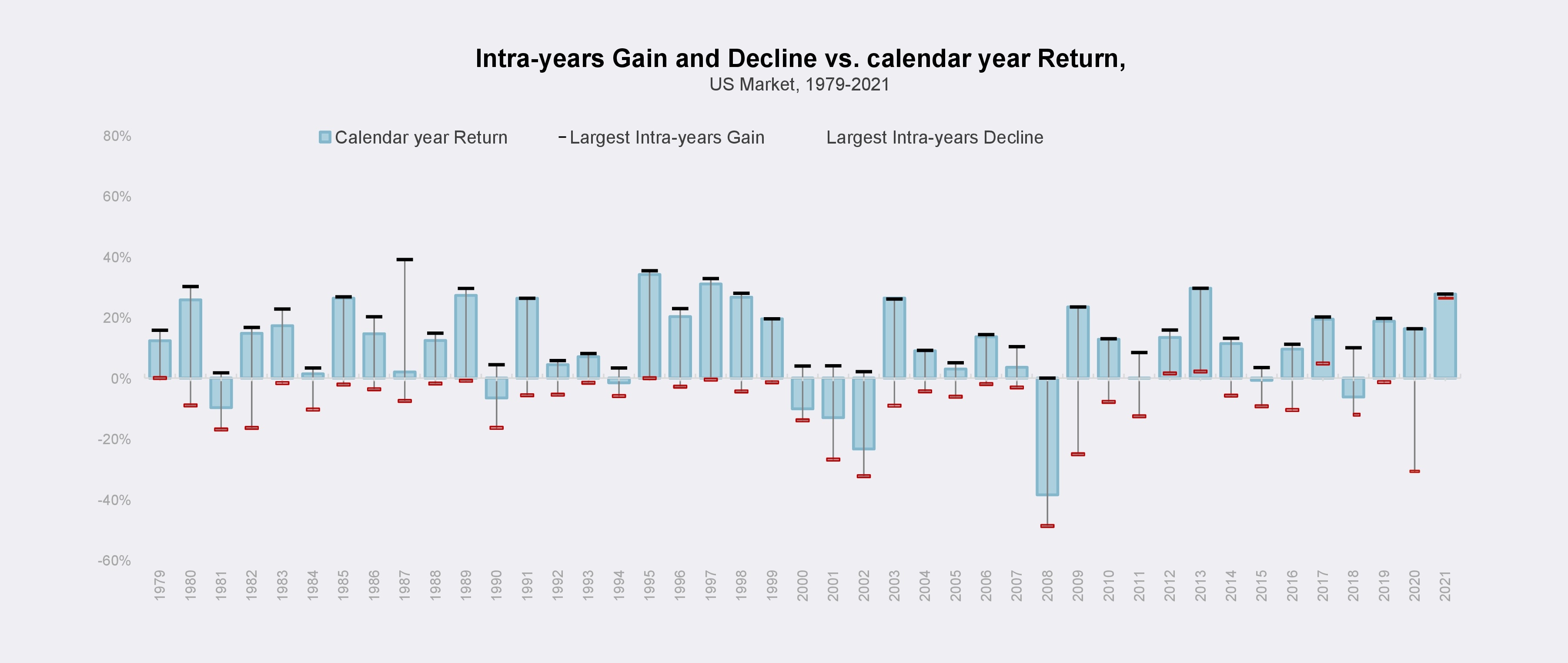

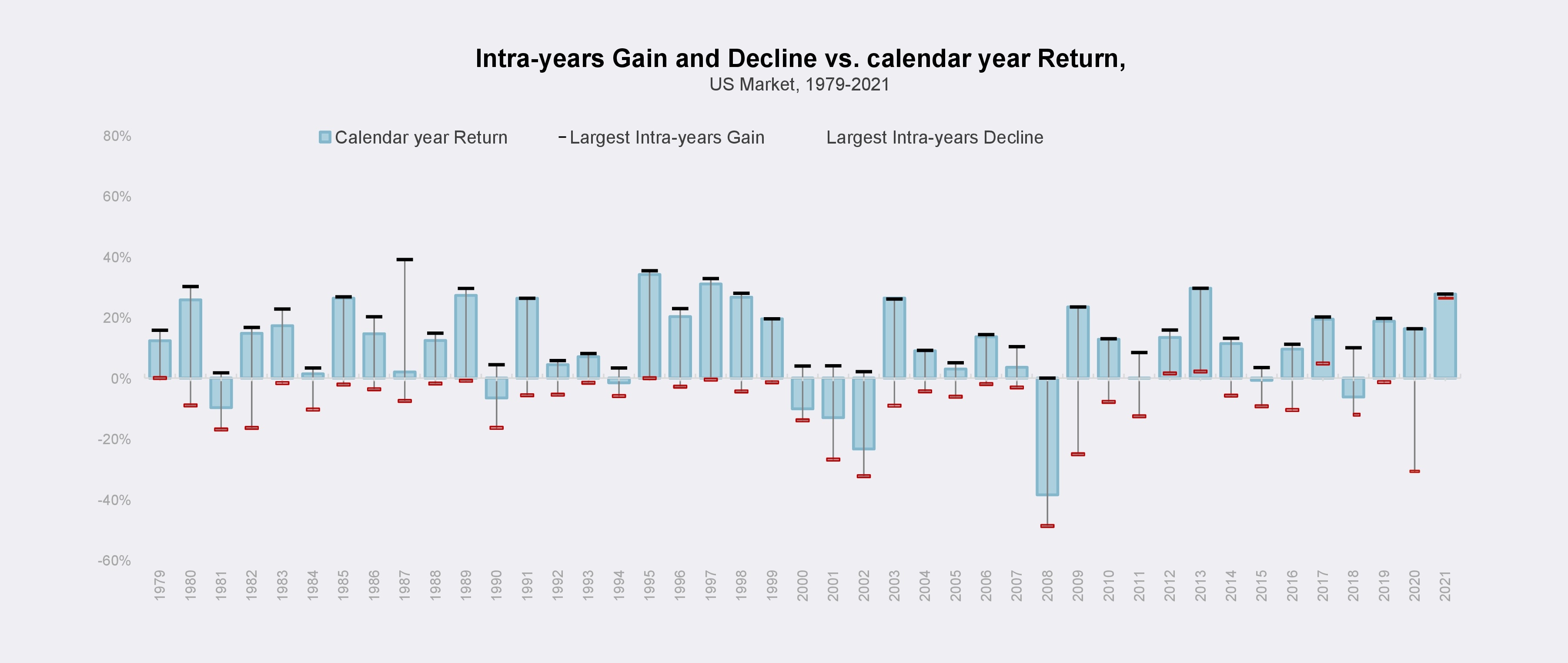

Calendar year returns for the US stock market since 1979 as well as the largest intra-year declines that occurred during a given year.

During this period,the average intra-year declined was about 14%. About half of the years observed had declines of more than 10%, and around a third had declined of more than 15%.

Despite substantial intra-years drops, calendar year returns were positive in 32 years out of the 37 examined.

This goes to show just how common market declines are and how difficult it is to say whether a large intra-year decline will result in negative returns over the entire year.

Emotion and trading are hazardous to your wealth

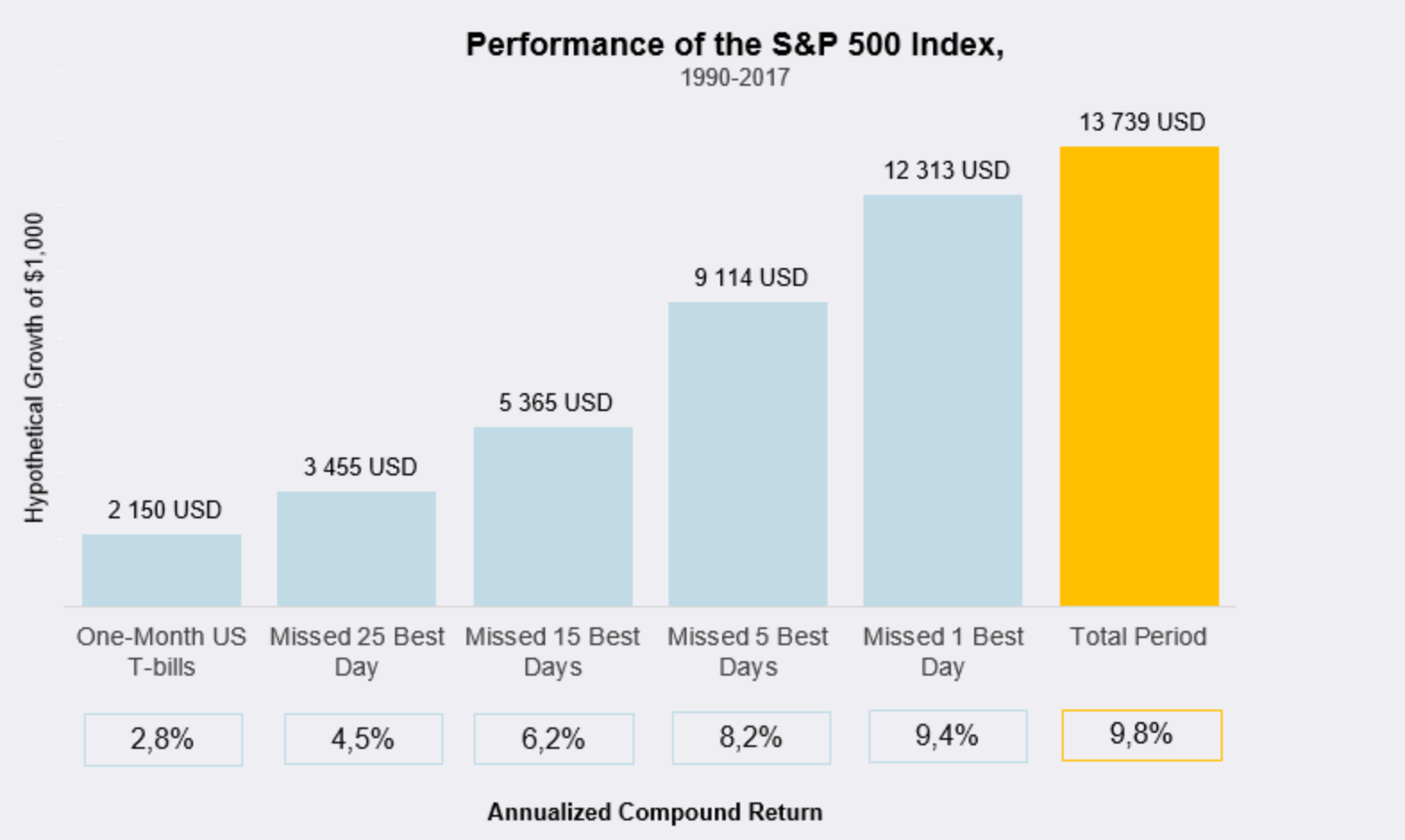

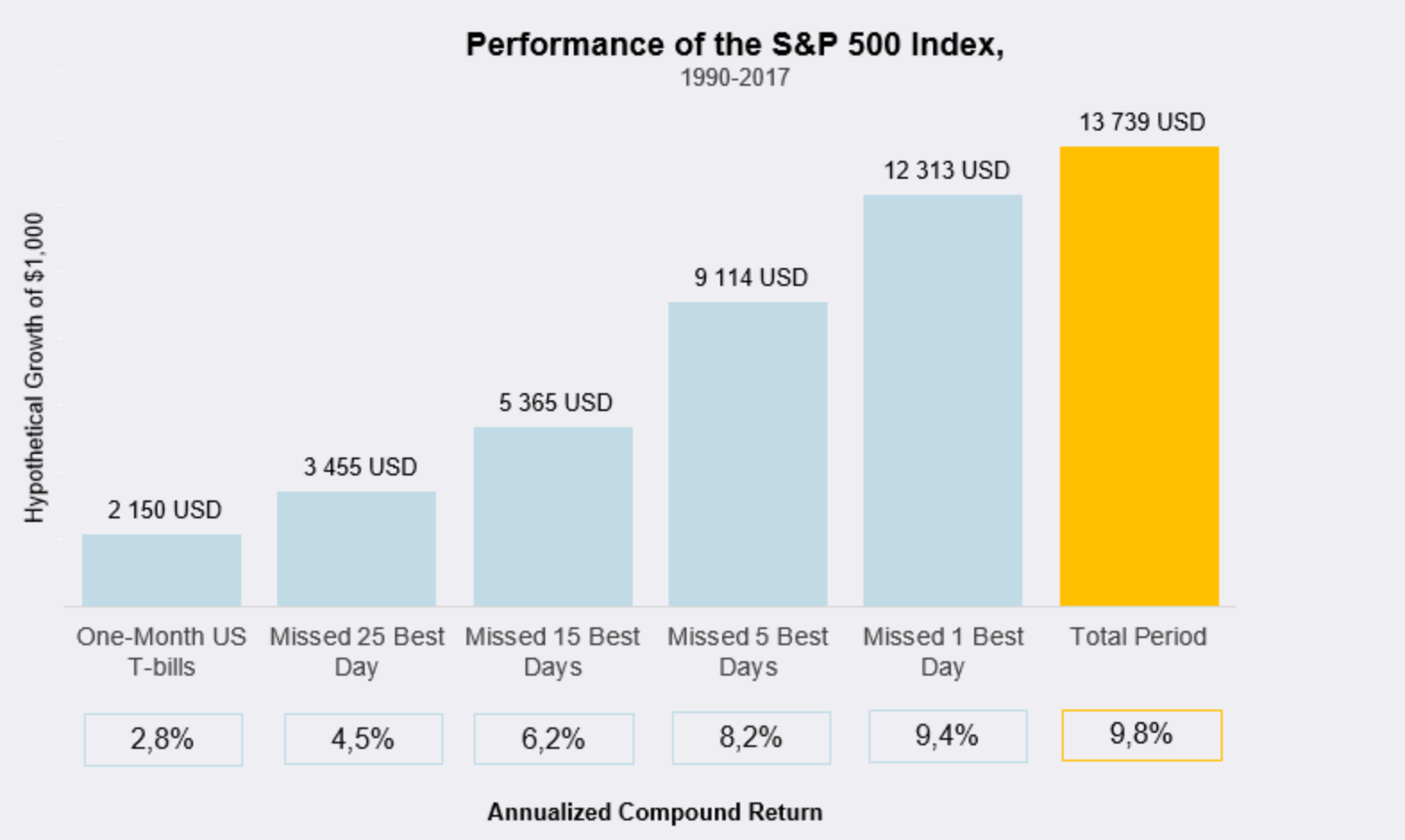

The 10 Best Days - Become a Better Investor:

- Missing only the 10 best days in 10 years seriously hurts you terminal wealth

- On average, you miss 66% of the gain, but can miss as much as 75%

Stay invested, so you don’t miss the 10 best days!

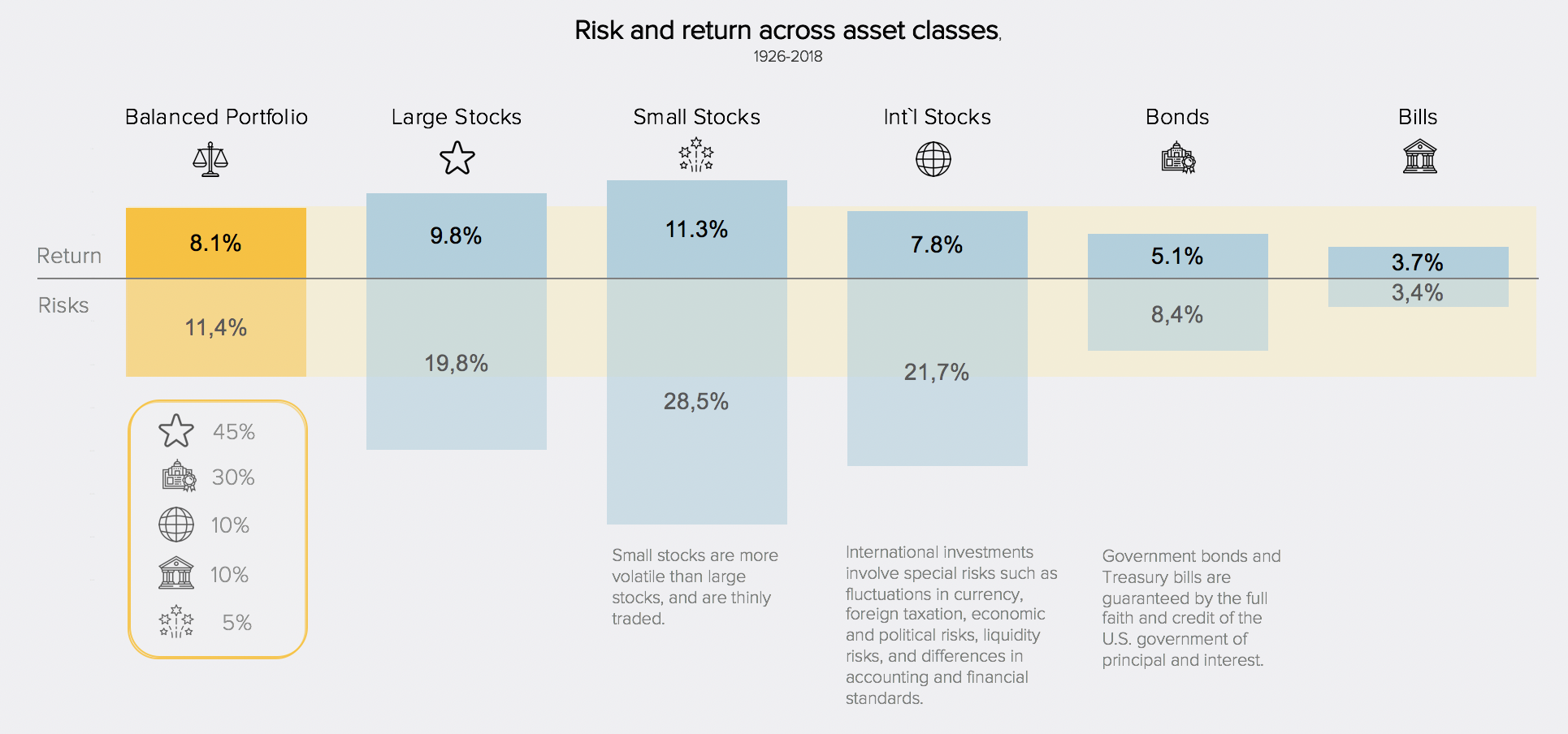

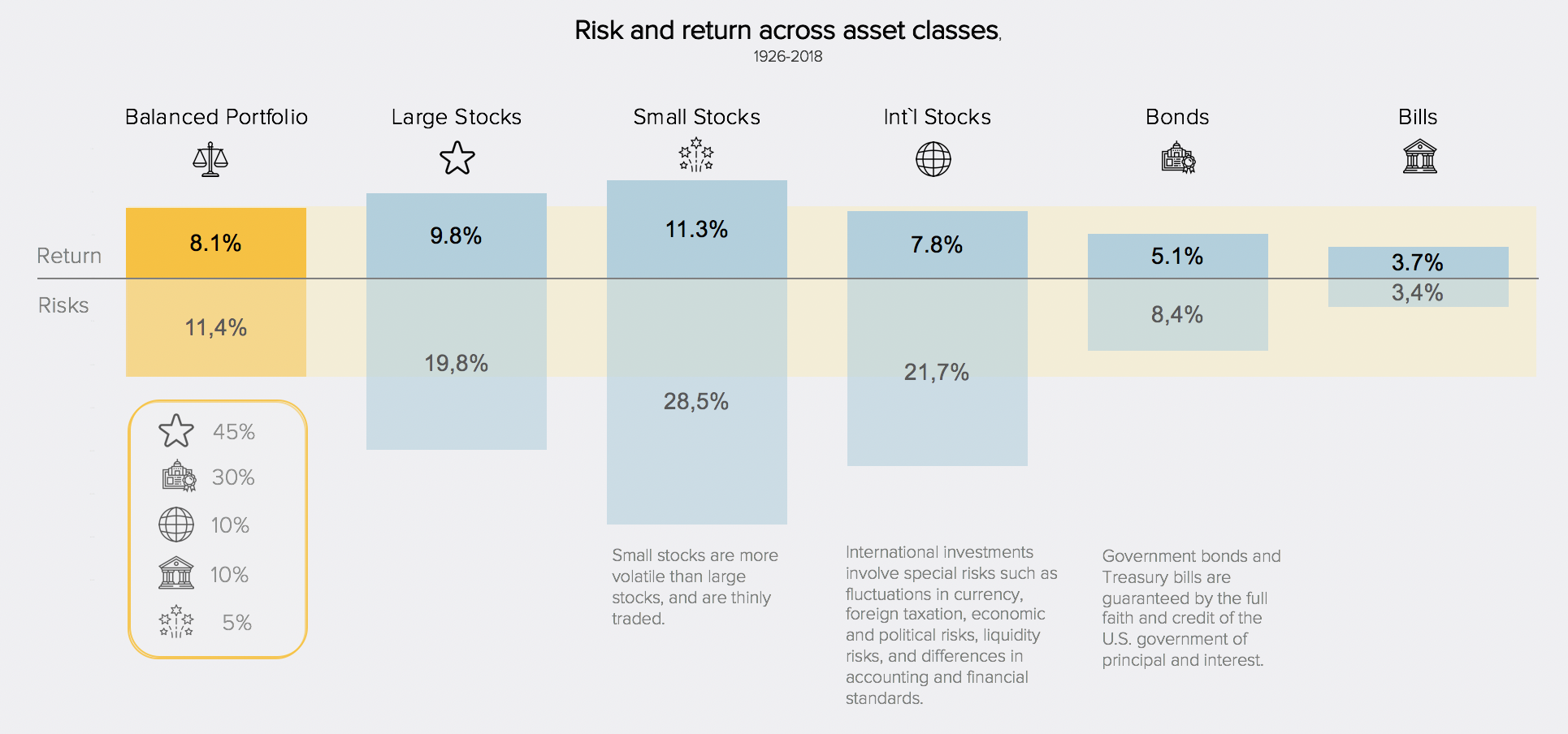

THE IMPORTANCE OF DIVERSIFICATION

A balanced portfolio has historically offered a desirable risk-return portfolio